33+ 50 debt to income ratio mortgage

Heres how lenders typically view DTI. Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes.

Debt To Income Ratio Loan Pronto

1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car.

. On the other hand if your gross monthly income is. Web Debt to Income Ratio Calculator Front-end debt ratio sometimes called mortgage-to-income ratio in the context of home-buying is computed by dividing total monthly. Comparisons Trusted by 55000000.

Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Ad 10 Best House Loan Lenders Compared Reviewed. Apply Now With Quicken Loans. Youll usually need a back-end DTI ratio of 43 or less.

Ad Compare Mortgage Options Calculate Payments. Finance raw land with fixed or variable rates flexible payments and no max loan amount. Try our mortgage calculator.

Web Lenders calculate your debt-to-income ratio by using these steps. Web To calculate your debt-to-income ratio add up your total recurring monthly obligations such as mortgage student loans auto loans child support and credit card. Lock Your Rate Today.

Ad 10 Best House Loan Lenders Compared Reviewed. Luckily there are ways to get. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Comparisons Trusted by 55000000. Apply Online To Enjoy A Service. Ad Calculate Your Payment with 0 Down.

That means if you earn 5000 in monthly gross income your total debt obligations should be. Lock Your Rate Today. Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent 2000 is 33 percent of 6000.

If your home is highly energy-efficient. Web In general lenders prefer that your back-end ratio not exceed 36. Get Instantly Matched With Your Ideal Mortgage Lender.

Web In general qualified mortgages limit the maximum total DTI to 43. Check Your Official Eligibility Today. Lock Your Mortgage Rate Today.

Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Your DTI is one way lenders measure your ability to manage. Were Americas Largest Mortgage Lender.

That means you can only have 43 of your income going to housing and other debt. Web How to get a loan with a high debt-to-income ratio. Web A good debt-to-income ratio for a mortgage is generally no more than 36 and lower is better because it shows lenders you are unlikely to default.

Web Your debt-to-income ratio tells you how much of your income is spoken for For example if 35 of your monthly earnings go toward debt payments you only have. Updated FHA Loan Requirements for 2023. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

Web Here are debt-to-income requirements by loan type. Ad Take the First Step Towards Your Dream Home See If You Qualify. Save Real Money Today.

Ad Get an idea of your estimated payments or loan possibilities. Ideally lenders prefer a debt-to-income ratio lower. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. Updated FHA Loan Requirements for 2023. Get Instantly Matched With Your Ideal Mortgage Lender.

A high debt-to-income ratio can result in a turned-down mortgage application. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Check Your Official Eligibility Today.

Highest Satisfaction for Home Loan Origination.

Home Mortgage Debt To Disposable Personal Income Ratio In The Us Download Scientific Diagram

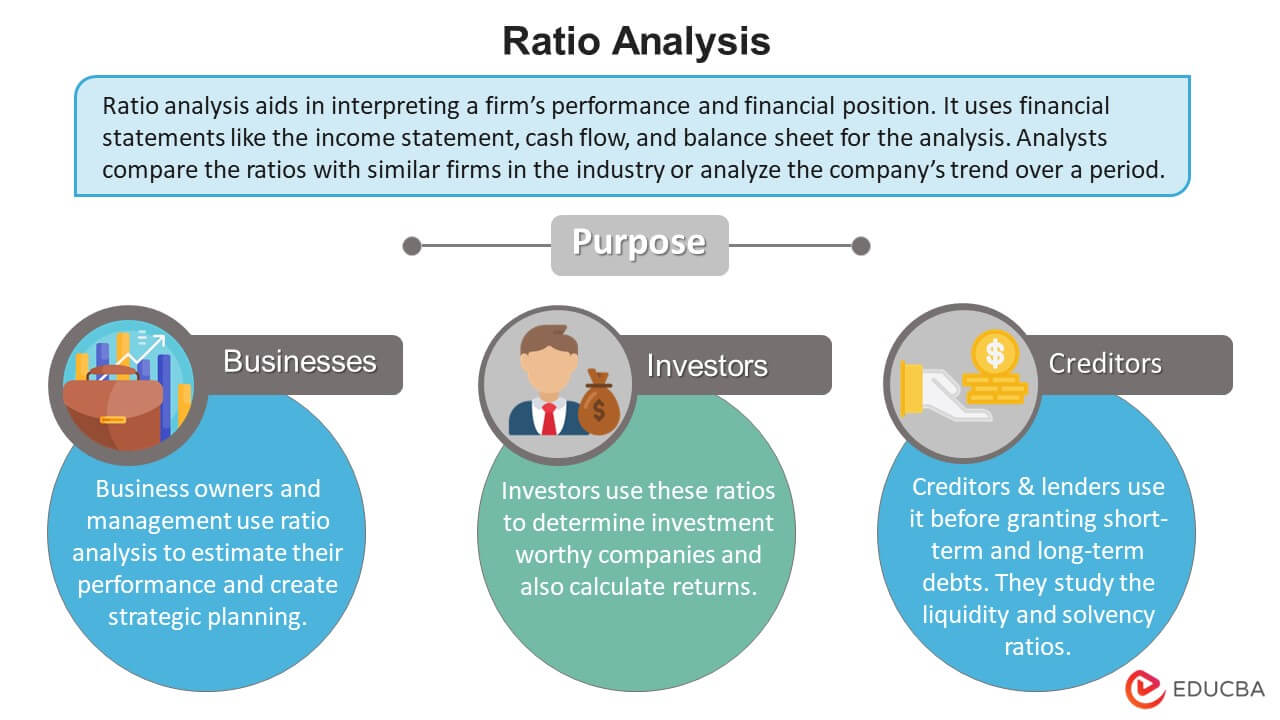

Ratio Analysis Meaning Limitations Formula Examples

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Calculate Your Debt To Income Ratio For A Mortgage

Jy Sjuabficqnm

Debt To Income Dti Ratio Calculator Money

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What S Considered A Good Debt To Income Dti Ratio

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

Este Ex992 35 Pptx Htm

Debt To Income Ratio Matters When You Re Buying A House Home

Debt To Income Ratio For Mortgage Definition And Examples

Annual Report 2003 2004

What S Considered A Good Debt To Income Dti Ratio

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Debt Income Ratio Calculator Front End Back End Dti Calculator For Mortgage Qualification